Ishbel Macpherson

6

Areas of Focus This Year

Key Responsibilities

Dear Shareholder

I am pleased to present the Directors’ Remuneration Report for the year ended 30 June 2022. Following this letter we have set out the following additional information:

There then follows the two principal sections of the Remuneration Report: the Annual Report on Remuneration and an abbreviated form of the Directors’ Remuneration Policy (the Policy) (the full version can be found at www.dechra.com). The Annual Report on Remuneration provides details of the amounts earned in respect of the 2022 financial year and how the Policy will be implemented in the 2023 financial year.

The Directors’ Remuneration Report (excluding the Policy) will be subject to an advisory vote at the 2022 Annual General Meeting.

Our Directors’ Remuneration Policy

The Policy was approved by shareholders at the Annual General Meeting on 27 October 2020, with 90.81% of all votes cast in favour, and will remain in force until 2023. We review the application of this Policy regularly, with a view to it remaining appropriate, linked to strategy and reflective of developing market practices. No changes to the Policy are proposed for the forthcoming year.

Further details on how the Policy was implemented during the 2022 financial year and our approach to the implementation of the Policy in the 2023 financial year, including our approach to performance measures for the annual bonus and LTIP awards, are described later in this letter.

Remuneration Committee Decisions in 2022

Our 2022 financial year has been another one of success for Dechra, with continued strong progress and a move into the FTSE100. On remuneration, our aim is to always consider the wider workforce, our shareholders and other stakeholders by taking a fair, prudent and balanced approach. The table below summarises the implementation of the Policy for Executive Directors in respect of the 2022 financial year.

| Element | Implementation |

|---|---|

Salary | As discussed with shareholders during our consultation process last year, Ian Page’s salary was increased to £612,000 and Paul Sandland’s to £405,000. The increases were effective from 1 January 2022. The 2022 base salary increase for Ian Page and Paul Sandland moved their base to around 90% of the market median of companies ranked 51 to 150 in the FTSE 350 and companies with a market capitalisation of £2.5 billion to £4.5 billion (based on 12 month average market capitalisation to 31 December of 2020). Tony Griffin’s salary was increased by 3% to €385,043, which was broadly in line with the average range of increases awarded to employees throughout the Group. |

Retirement Benefit | Company pension contribution/cash in lieu of pension of 8% of salary for Ian Page and 6% of salary for Paul Sandland. Tony Griffin received an employer’s contribution of 7.7% of salary into the Netherlands pension scheme. In line with the commitment made in our 2020 Remuneration Report, the employer pension contribution rate for our UK employees was increased to 8% from 1 July 2022. |

Annual Bonus | Maximum opportunity for the 2022 financial year of 125% of base salary. The bonus for the 2022 financial year was based on underlying profit before tax (as regards up to 110% of salary), personal objectives (up to 10% of salary) and ESG measures (up to 5% of salary). We have delivered underlying profit before tax during the year of £170.0 million, an improvement of 15.5% at constant exchange rates (13.3% at actual exchange rates) on the prior year. Reflecting the performance of the Group in relation to profit targets and the performance of Executive Directors against personal objectives and ESG measures as described on pages 134 to 136, bonuses for the year equal to 92.0% of salary have been earned by Ian Page and Paul Sandland. The profit element of Tony Griffin’s bonus is calculated by reference to the underlying operating profit of Dechra Veterinary Products EU (up to 55% of salary) and Group underlying profit before tax (up to 55% of salary). His bonus earned for the year is 76.5% of salary, which reflects the financial performance and the satisfaction of his personal objectives and ESG measures. The Committee considers the level of payout is reflective of the overall performance of the Group in the year and is appropriate. The bonus is subject to a bonus deferral, requiring that 20% of any bonus earned is deferred into Dechra shares for two years. The annual bonus is subject to malus and clawback provisions. |

Long Term Incentive Plan | Awards of 200% of base salary for Ian Page, 150% of base salary for Paul Sandland and 100% of base salary for Tony Griffin were granted in September 2021. All of these awards are subject to a two year post vesting holding period. LTIP awards granted on 6 September 2019 are scheduled to vest on 5 September 2022:

In aggregate, taking into account the ROCE underpin (reflecting that the ROCE at 19.5% had not fallen below 10.0%), the LTIP awards will vest as to 65.5%. The Committee considers the level of payout is reflective of the overall performance of the Group over the three year performance period ended 30 June 2022 and is appropriate. See page 139 for further details. Awards made under the LTIP are subject to malus and clawback provisions |

Chair's Fee

In last year’s Remuneration Report we reported that we decided to increase the Chair’s fee in two stages, with an increase to £159,000 (which included the fee for being Chair of the Nomination Committee, £5,000) from 1 January 2021 and to £188,000 from 1 January 2022.

As part of the Shareholder Consultation on Remuneration, which was undertaken between February and July 2021, we highlighted that we would revisit the appropriate fee level in the event of Dechra becoming a constituent of the FTSE 100, or in the event of a change of Chair. On the appointment of Alison Platt as Chair in January 2022 the Chair’s fee was set at £200,000. This positions the Chair fee below lower quartile compared to the FTSE 30–100 and around lower quartile of the FTSE 100–150. As at 1 July 2022, Dechra was ranked 95 in the FTSE 100.

Performance Conditions for LTIP Awards

As detailed in the Directors’ Remuneration Report last year, the impact of the Akston licensing agreement is relevant for the 2020 Grant (three year performance period to 30 June 2022) and 2021 Grant (three year performance period to 30 June 2023). In order to measure performance on a fair and consistent basis, the Committee has adjusted the final year underlying EPS for the 2020 Grant to reflect the actual Akston R&D costs incurred at the vesting date. This adjustment recognises that these R&D costs were not included in the base year of the performance period and maintains the overall level of stretch in the targets so the targets are not less difficult to satisfy. For the 2022 Grant (three year performance period to 30 June 2024) and future years, the Committee is mindful that the base year will have some R&D actual costs from the Akston deal. Therefore, the actual Akston R&D costs will be adjusted for both the base year and the year of vesting to enable performance to be measured on a like-for-like basis as was agreed for the 2021 Grant. The Committee believes that this is the right approach as the payments for the development of Akston are lumpy and uncertain as to timing between financial years.

Forward Looking: Implementation of Policy for 2023 Financial Year

We will apply the Policy in the 2023 financial year as follows (more information is given on page 144 of the 2022 Annual Report):

In line with our Policy for the Chief Executive Officer and the Chief Financial Officer, the level of bonus deferred into Dechra shares for two years will increase from 20% to 33% of any bonus earned (and not just any additional bonus earned). The increase in the level of deferral alongside the increase in the maximum bonus opportunity means that the amount of cash earned for any level of performance is not increased. The increase in the bonus opportunity is, therefore, delivered in deferred shares, which further enhances the alignment with shareholders. The bonus will be based on a mix of stretching underlying profit before tax targets (in respect of a bonus of up to 130% of salary), personal objectives (in respect of a bonus of up to 10% of salary) and an ESG measure (in respect of a bonus of up to 10% of salary).

The bonus opportunity for Tony Griffin will remain at 125%. The level of bonus deferred into Dechra shares for two years will be 20% of any bonus earned (and not just any additional bonus earned). The bonus will be based on a mix of stretching underlying profit targets (in respect of a bonus of up to 105% of salary), personal objectives (in respect of a bonus of up to 10% of salary) and an ESG measure (in respect of a bonus of up to 10% of salary). For Tony Griffin, and consistent with the approach for the 2022 financial year, half of the opportunity based on underlying profit (i.e. up to 52.5% of salary) will be assessed by reference to the underlying operating profit of Dechra Veterinary Products EU, reflecting his responsibility for that part of our business, and the other half of the profit based opportunity by reference to Group underlying profit in line with the other Executive Directors, so that a significant part of the profit based opportunity is aligned with the shareholder experience in respect of overall Group performance.

The Committee has also reviewed the level of stretch in the annual bonus targets to reassure itself that the higher maximum opportunity for the 2023 financial year will only be earned for delivery of appropriately stretching levels of performance.

Chair and Non-Executive Directors

A review of the Chair and Non-Executive Directors’ base and additional fees will also be undertaken in January 2023 along with the pay review process for the wider workforce.

Wider Workforce Remuneration and Employee Engagement

We recruit and promote people on the basis of their personal ability, contribution and potential. We are committed to promoting, supporting and maintaining a culture of fairness, respect and equal opportunity for all. We are also committed to fair employment practices and comply with national legal requirements regarding wages and working hours.

The Group aims to provide a remuneration package that is competitive in an employee’s country of employment and which is appropriate to promote the long term success of the Group. The Company’s SAYE scheme and Employee Stock Purchase Plan (ESPP) encourage share ownership by qualifying employees and enable them to share in value created for shareholders. In the 2022 financial year, we offered SAYE to 1,636 employees in 19 countries, and received a 38.57% take up. In the 2023 financial year, we propose to offer the SAYE to our employees in Brazil, so offering 270 additional employees the opportunity to acquire shares in Dechra.

Further details on our pay principles and workforce remuneration are set out on page 129 of the 2022 Annual Report.

As the Non-Executive Director designated under the 2018 Code for employee engagement, Lisa Bright engages directly with employees on a range of topics of interest to them. As discussed on page 101, workforce engagement activities during the 2022 financial year included seven discussions with cross function teams in the EU and US. These have provided an upward channel for views, comments and debate, as well as an opportunity to provide positive feedback on the Group’s decision not to furlough employees during the pandemic. The Committee provided an update on the Remuneration Review, including the Executive Directors’ remuneration increases, to the wider workforce via the OneDechra intranet.

Gender Pay

We are pleased to report that, as a result of our proactive management with regards to our gender pay gap in Dechra Limited (who employ 69.3% of our UK employees), the gap has reduced from 17.7% in 2017 to 2.8% in 2021. However, the latest decrease relates largely to the payment of COVID-19 bonuses to all site-based staff at the Skipton site during the pandemic and will rise again next year as this is not applicable on an ongoing basis.

Looking Ahead: Key Focus Areas for the Committee for 2023

During the course of the 2023 financial year, we will be reviewing our Policy to check that it continues to support our strategic priorities. The Committee is mindful of the need to attract and retain high calibre individuals in an increasingly competitive market and to remunerate executives fairly and responsibly. As part of this review, and alongside the development of our science based climate targets, we will also consider the extent to which we should enhance the focus on ESG targets in the reward framework. We will consult with our shareholders in advance of the next triennial shareholder vote on the policy at the 2023 Annual General Meeting.

I will also transfer Remuneration Committee responsibilities to a new Committee Chair during the course of the year.

In Conclusion

We greatly appreciate the feedback and the level of support we have received from shareholders regarding our approach to remuneration.

We remain committed to a responsible approach to executive pay, as I trust this Directors’ Remuneration Report demonstrates. We believe that the Policy operated as intended and consider that the remuneration received by the Executive Directors in respect of the 2022 financial year was appropriate, taking into account Group performance, personal performance and the experience of shareholders and employees.

I trust that we will continue to receive your support at the Annual General Meeting later this year. Should you have any queries in relation to this report, please contact me or the Company Secretary.

Ishbel Macpherson

Remuneration Committee Chair

5 September 2022

Our pay principles adopted in the 2020 financial year and detailed below, support us in attracting, motivating and retaining the key talent required to support the sustainable improvement of animal health and welfare globally.

Equal pay for work of equal value

We aim to remain competitive on compensation in our different marketplaces, whilst maintaining internal integrity

We set a target to become a real Living Wage Employer* in the UK during the 2021 financial year. Living wages vary by country, but our aim does not. As we continue to grow in countries across the globe, we will implement elsewhere in the world**

We want to increase the number of employees who are able to hold a stake in the Company through employee share ownership

In addition to base pay, we have a number of different local incentive schemes across the Group

* Defined in the UK by The Living Wage Foundation.

** Implemented early during the 2021 financial year

| Executive Directors | Senior Executive Team | Wider Workforce | |

|---|---|---|---|

| Base Salary | Increases considered in the context of business wide review of remuneration, focusing on the lowest paid in our organisation and the top 60 Senior Leaders. | We are accredited as a Living Wage Employer in the UK and have implemented the equivalent elsewhere in the world. | |

| Pension | Ian Page: Reduced to 8% of base salary with effect from 1 July 2021. Paul Sandland: 8% of base salary with effect from 1 July 2022 in line with the increase in the employer pension contribution rate for the UK wider workforce. Tony Griffin: 7.7% of base salary pension contribution in line with the employer pension contribution for the wider Dutch workforce. | Between 8% and 12% of base salary dependent on length of service. | For the 2021 financial year: between 6% and 12% of base salary dependent on length of service and/or grade*. We increased our minimum employer pension contribution from 6% to 8% with effect from 1 July 2022 in the UK. |

| Bonus | 125% of base salary for the 2022 financial year, 150% of base salary for the 2023 financial year for Ian Page and Paul Sandland and 125% for Tony Griffin. Ian Page and Paul Sandland: Targets for the 2023 financial year: personal (up to 10% of salary), ESG (up to 10% of salary) and financial (up to 130% of salary). Tony Griffin: Targets for the 2023 financial year: personal (up to 10% of salary), ESG (up to 10% of salary) and financial (up to 105% of salary). | Increased from 50% of salary to 75% of salary for 2022 financial year. Targets: from 1 July 2021 financial and personal. From 1 July 2022 financial, ESG and personal. | All senior managers and professionals. Max. 40% of base salary. Targets: financial and personal. |

| Long Term Incentive Plan | Max. 200% of base salary. Currently 200% of base salary for Ian Page, 150% of base salary for Paul Sandland and 100% of base salary for Tony Griffin. Three year performance period, two year holding period. Target: TSR (one third), underlying diluted EPS (two thirds) and ROCE underpin. | Max. 100% of base salary. Three year performance period. Target: TSR and underlying diluted EPS with a ROCE underpin. | All senior managers and professionals. Discretionary awards. Market value options, three year performance period. Target: EPS growth 12% above inflation. |

| Sharesave† | Up to £500 per month Three year savings period or two years for the Employee Stock Purchase Plan (US). | ||

* Data provided for UK only.

† Austria, Belgium, Canada, Croatia, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Slovenia, Spain, Sweden, UK and USA.

The Link between our Directors’ Remuneration Policy and our Strategy

The table below describes how certain remuneration elements are linked to our strategy.

Our annual bonus incentivises the delivery of the long term strategy through the achievement of short term objectives.

Up to 130% of salary can be earned based on a stretching profit target, which requires performance above budget and market expectations to trigger the payment of a maximum bonus.

Up to 10% of salary can be earned based on the achievement of personal objectives, which reflect the priorities of the business, achievement of which is necessary to deliver the longer term strategy.

Up to 10% of salary can be earned based on ESG measures.

The LTIP is designed to reward the generation of long term value for shareholders. Performance measures reflect our long term objectives, including sustainable profit growth and the enhancement of shareholder value. Awards are based on growth in underlying diluted EPS and the delivery of shareholder returns. For the 2022 and 2023 financial year awards, the weightings are two thirds underlying diluted EPS and one third total shareholder return.

The application of a ROCE underpin focuses Executives on using capital efficiently and appropriately to allow the business to capitalise on growth opportunities in new territories and markets, whilst maintaining returns.

The post vesting holding period aligns management with the long term interests of shareholders and the delivery of sustained performance.

The performance conditions for LTIP awards made in respect of the year ended 30 June 2022 and future years include discretion to override formulaic outcomes.

.

In determining the Policy, the Committee took into account the principles of clarity, simplicity, risk, predictability, proportionality and alignment to culture, as set out in the Code.

Remuneration arrangements should be transparent and promote effective engagement with shareholders and the workforce.

Our remuneration arrangements are transparent and aligned with our Purpose, Values and Strategy and our disclosures are clear to both our shareholders and our employees. Performance targets are set in line with Group budgets and plans and reviewed and tested by the Committee.

Remuneration structures should avoid complexity and their rationale and operation should be easy to understand.

We believe that our remuneration structures are as simple as they practicably can be. We follow a standard UK market approach to remuneration with established variable incentive schemes that operate on a clear and consistent basis.

Remuneration arrangements should ensure reputational and other risks from excessive rewards, and behavioural risks that can arise from target-based incentive plans, are identified and mitigated.

The range of possible values of rewards to individual directors and other limits or discretions should be identified and explained at the time of approving the policy.

The range of possible values of rewards and other limits or discretions can be found in the full Policy included in the 2022 Remuneration Report, and the Risk section above refers to limits and Committee discretion.

The link between individual awards, the delivery of strategy and the long term performance of the Company should be clear. Outcomes should not reward poor performance.

The variable elements of awards are linked to base salary. The performance targets are closely linked to the corporate, financial, strategic and other non-financial objectives of the Company. This enables the Committee to reward the Executive Directors’ contribution to both the annual financial performance and the achievement of specific objectives of the Company, so that poor performance cannot be rewarded. In determining the Policy, the Committee was clear that this should drive the right behaviours, reflect our Values and support the Company Purpose and Strategy. The Committee will review the remuneration framework regularly so that it continues to support our Strategy.

Incentive schemes should drive behaviours consistent with Company Purpose, Values and Strategy.

The variable elements of awards are linked to base salary. The performance targets are closely linked to the corporate, financial, strategic and other non-financial objectives of the Company. This enables the Committee to reward the Executive Directors’ contribution to both the annual financial performance and the achievement of specific objectives of the Company, so that poor performance cannot be rewarded. In determining the Policy, the Committee was clear that this should drive the right behaviours, reflect our Values and support the Company Purpose and Strategy. The Committee will review the remuneration framework regularly so that it continues to support our Strategy.

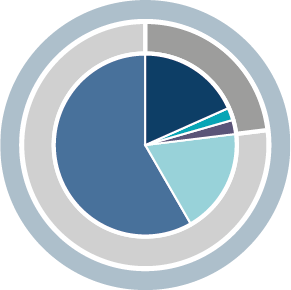

Ian Page

2021

2022

| 2021 | 2022 | ||

|---|---|---|---|

| Fixed | |||

| Salary | 18.4% | 28.8% | |

| Benefits | 2.3% | 3.1% | |

| Pension | 2.6% | 2.3% | |

| Performance-linked | |||

| Bonus | 18.4% | 26.5% | |

| LTIP | 58.3% | 39.3% |

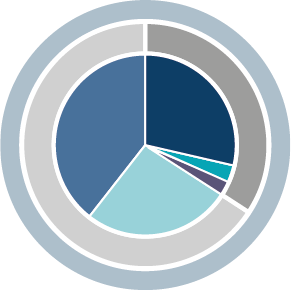

Paul Sandland

2021

2022

| 2021 | 2022 | ||

|---|---|---|---|

| Fixed | |||

| Salary | 46.9% | 41.1% | |

| Benefits | 4.4% | 3.5% | |

| Pension | 1.8% | 2.5% | |

| Performance-linked | |||

| Bonus | 46.9% | 37.7% | |

| LTIP | N/A | 15.2% |

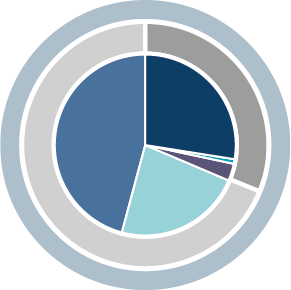

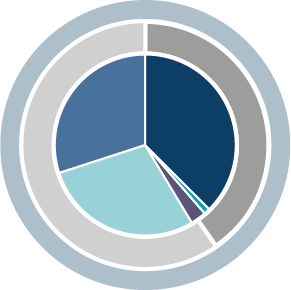

Tony Griffin

2021

2022

| 2021 | 2022 | ||

|---|---|---|---|

| Fixed | |||

| Salary | 27.5% | 37.7% | |

| Benefits | 0.8% | 1.0% | |

| Pension | 3.0% | 2.9% | |

| Performance-linked | |||

| Bonus | 22.8% | 28.6% | |

| LTIP | 45.9% | 29.8% |