This year marks Dechra’s 25th anniversary. Our Values, our Culture, people, and strategy have established Dechra as one of the leading and fastest growing global animal health companies in the world."

Alison Platt

Dear Shareholder

On behalf of the Board, I am pleased to present Dechra’s Governance report for the year ended 30 June 2022. This is my first report on behalf of the Board, following my appointment as Chair on 1 January 2022.

Board Appointments

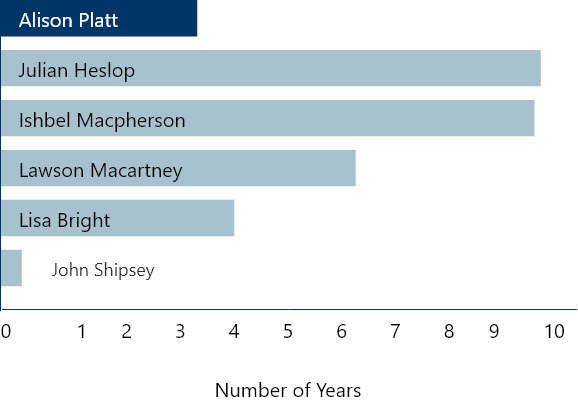

There have been a number of Board changes in the 2022 financial year. In September 2021, the Company announced that Tony Rice, who had been Chair for five years, wished to retire from the Board to devote more time to family and other business and charitable activities. Tony retired on 31 December 2021.

Denise Goode decided to tender her resignation, in November 2021, due to other commitments, and the Board agreed that Julian Heslop should resume the role of Audit Committee Chair whilst a successor was appointed. After an extensive search, John Shipsey was appointed as a Non-Executive Director on 1 June 2022. He brings a wealth of financial and commercial experience to the business following his recent tenure as Chief Financial Officer at FTSE100 Smiths Group PLC and a number of senior finance and strategy roles over the last 20 years. We announced in May 2022 that John would replace Julian Heslop as Audit Committee Chair on 1 September 2022, at which point Julian was subsequently asked by the Committee to sign the Audit Committee Report for the financial year ended 30 June 2022, and has, therefore, agreed to defer his retirement to 5 September 2022.

As communicated in previous Committee reports, the Remuneration Committee Chair (and previously the Senior Independent Non-Executive Director), Ishbel Macpherson, will be retiring in the 2023 financial year. Cognisant of the Parker Review requirements and the new listing requirements regarding diversity targets, the Committee has retained a recruitment consultant who specialises in diverse recruitment to find our new Chair of Remuneration. Following my appointment as Chair, Lawson Macartney took over the role of Senior Independent Director earlier this year.

Purpose and Culture

Our Purpose is clearly defined and underpinned by our Culture and Values. Further details can be found on pages 10, 54 and 55, and 93. Our Values, entrepreneurial attitude and agile approach are the backbone of our Culture. We expect our people to make a difference by working together, and we support them by providing clear guidance on expectations.

This year marks Dechra’s 25th anniversary. Our Values, our Culture, people, and strategy have established Dechra as one of the leading and fastest growing global animal health companies in the world and it was a privilege to meet the 100 colleagues who attended the Global Team Meeting in Cheshire recently to celebrate this milestone.

During the year, the Board attended its first site visit in over two years at our site in Uldum, Denmark. Whilst the COVID-19 pandemic restricted our ability to travel, the Board made good use of technology to stay connected to colleagues around the Dechra network.

Throughout the year, we have routinely reviewed the policies which support and enable our Values. Core to this is our Code of Conduct, which includes a set of simple one page policy documents. A Code of Conduct e-learning course was rolled out globally in January 2022. The Board approved the launch of a third party confidential hotline, which went live globally in April 2022, and is available to both employees and Dechra’s third parties. Reports can be submitted through an online portal, which is available in 46 languages, or via a hotline, which is manned twenty-four hours a day and is supported in 170 languages.

Stakeholders and Section 172 Companies Act

The impact of our decisions on our key stakeholders is front of mind in our decision making. Details of how we consider stakeholders in the Board’s decisions and approvals of material transactions, our engagement with stakeholders and our approach to section 172 of the Companies Act 2006 can be found on pages 52 to 63 and 96 to 98

Board Activities

The current financial year has seen our continued focus on both strengthening the core operations and growing the business. We approved important investments in manufacturing enabling greater resilience and reducing reliance on third party suppliers. We secured the worldwide rights to verdinexor, a novel treatment of all forms and stages of canine lymphoma in dogs.

To achieve the Group’s aim of ensuring diversified sources of funding and to extend the Group’s debt maturity profile, the Board approved a private placing of EUR50 million seven year and EUR100 million ten year new senior unsecured notes, which was signed post year end on 14 July 2022. All proceeds from the placement were used to repay existing debt on the Group’s Revolving Credit Facility

Post year end, we also approved a placing of 5,247,813 new ordinary shares and a retail offer of 116,870 new ordinary shares. In aggregate, the placing shares and the retail offer shares represented approximately 4.95% of the Company’s existing issued share capital, raising gross proceeds of £184.0 million for the Company. The proceeds were used to fund the acquisition of Piedmont Animal Health, Inc. a research and development business with an active product pipeline in North Carolina, USA, and will also provide balance sheet flexibility to execute on an active acquisition pipeline. Piedmont specialises in developing novel and differentiated products for the companion animal market and has a strong development track record.

Compliance with the Code

The UK Corporate Governance Code 2018 (the Code) establishes the principles of good governance for companies; this Governance section of the 2022 Annual Report describes how the Company has applied these principles and complied with the provisions, as well as how it meets other relevant requirements, such as the provisions of the Listing Rules and Disclosure and Transparency Rules (DTR) of the Financial Conduct Authority

In the opinion of the Directors, the Company has complied with the Code throughout the period, with the exception of provision 38 of the Code ,which relates to the alignment of executive directors' pension contributions to those of the wider UK workforce. This has now been achieved as from 1 July 2022, two of our Executive Directors’ pension contributions were at 8%, which matches the minimum offered to our UK workforce. Tony Griffin's pension contribution is at 7.7%, which is aligned with the Dutch workforce contribution.

The Board remains committed to maintaining high standards of corporate governance. The Code can be found at www.frc.org.uk.

Relations with Shareholders

The Annual General Meeting will be held in Northwich on 20 October 2022 (the Meeting). All members of the Board are scheduled to attend the Meeting and the Chair of the Audit, Remuneration and Nomination Committees will be available to answer shareholders’ questions at the Meeting.

Looking Forward

Finally, should you have any questions in relation to this report, please feel free to contact me or the Company Secretary.

Alison Platt

Non-Executive Chair

5 September 2022

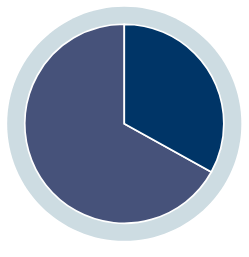

| Female | 33.3% (3) | |

| Male | 67.7% (6) |

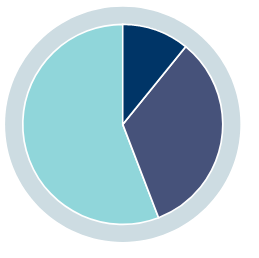

| Non-Executive Chair | 11.1% (1) | |

| Executive Directors | 33.3% (3) | |

| Non-Executive Directors | 55.6% (5) |

| Name | |||||||

|---|---|---|---|---|---|---|---|

| Skills | Leadership | ||||||

| Industry Experience | Knowledge of Sector | Understanding of Regulatory Process (Pharma) | Strategic Thinking | Governance | Risk Management | Financial | |

| Ian Page | |||||||

| Paul Sandland | |||||||

| Tony Griffin | |||||||

| Alison Platt | |||||||

| Julian Heslop | |||||||

| Ishbel Macpherson | |||||||

| Lawson Macartney | |||||||

| Lisa Bright | |||||||

| John Shipsey | |||||||

Th Board is scheduled to meet seven times a year, the Remuneration and Audit Committees four times a year and the Nomination Committee three times a year. The June 2022 meetings were rescheduled to July 2022 to coincide with the Global Team Meeting. All meetings to and including these dates, 12 and 13 July respectively, have been included in this table.

| Board | Audit | Remuneration | Nomination | |

|---|---|---|---|---|

| Alison PlattΩ | 10 10 | 2 2 | 6 6 | 4 5 |

| Ian Page | 10 10 | N/A | N/A | N/A |

| Tony Griffin | 10 10 | N/A | N/A | N/A |

| Paul Sandland | 10 10 | N/A | N/A | N/A |

| Lisa Bright | 10 10 | 4 4 | 6 6 | 5 5 |

| Julian Heslop¶ | 9 10 | 4 4 | 6 6 | 5 5 |

| Lawson Macartney | 10 10 | 4 4 | 6 6 | 5 5 |

| Ishbel Macpherson | 10 10 | 4 4 | 6 6 | 5 5 |

| John Shipsey* | 4 4 | N/A | 1 1 | 1 1 |

| Tony Rice† | 3 3 | N/A | 3 3 | 2 2 |

| Denise Goode‡ | 2 2 | 1 1 | 2 2 | 1 1 |

Key

Number of meetings attended

Number of meetings

† Tony Rice attended all meetings until his retirement.

‡ Denise Goode attended all meetings until her resignation.

* John Shipsey attended all meetings since his appointment.

ΩAlison Platt did not attend one Nomination Committee meeting as the meeting had been convened solely to discuss the candidates for the role of Chair. Alison attended all Audit Committee meetings prior to her appointment as Chair.

¶ Julian Heslop was unable to attend an adhoc Board meeting due to a prior commitment; however, he provided the Board with his comments and questions on the subject matter under discussion. He was also unable to attend one adhoc Remuneration Committee due to a prior commitment.

The Board recognises that excellence in corporate governance is important in order to generate and protect value for our investors. Our governance structure is designed to maintain effective control and oversight of our business, whilst at the same time promoting the entrepreneurial spirit that has underpinned Dechra’s success to date. Details in relation to our prudent and effective controls can be found on AR page 92, stakeholder engagement on pages 96 to 98 and Culture, Purpose and Values on page 93.

We have a strong and balanced Board with a range of complementary skills to support the strategic and operational direction of the Group. The Senior Executive Team (SET) has the responsibility for the overall leadership of the Group, driving the successful implementation and execution of the strategy.

The report from our Nomination Committee on AR pages 107 to 116 sets out the appointment process, its approach to succession for appointments to the Board and SET, the implementation and progress of the Group’s diversity policy. Details in relation to our succession planning and the external Board evaluation can be found on AR pages 107, 114 and 115.

The report from our Audit Committee on AR pages 117 to 124 contains details on how it has assisted the Board in reviewing the financial reporting and internal financial control effectiveness, and the monitoring of the effectiveness of the external audit process and internal audit function. Further details in respect of the Group’s risk management and internal control processes are provided on pages 75 to 80 of the Strategic Report, along with the principal risks, controls and mitigating actions, and emerging risks.

Our Remuneration Policy is designed to promote the long term success of the Group and to reward the creation of long term value for shareholders. The Remuneration Committee has taken into account the pay and principles applied to the wider workforce and the culture of the Company when setting the remuneration of both the Executive Directors and the SET. Further details can be found on AR pages 128 and 129. During the year, we have undertaken a shareholder consultation on the remuneration of our Executive Directors.